Enter a Journal Entry

This is the system used to enter any kind of General Journal Entry - a Debit and a Credit. You can enter any kind of General Journal Entry (Debit and Credit) here. See Accounting for Dummies

TUTORIAL SCENARIO

This will be an example of making a Cash Disbursement - an expense that you have paid, most likely you issued a hand written check for this expense. It is entered by Adding A GL Transaction. It does not go through Accounts Payable, since you already paid it. In accounting, a Cash Disbursement consists of debiting the Expense and crediting the Cash, both for the amount of the expense.

For a Cash Disbursement, you must enter two transactions, one for the credit to your Cash Account - G/L Number 10000 to 19999 (see your printout of Company Chart of Accounts) and the other to debit the Expense Account. If the expense is to be billed to the Investors, it should be debited to one of the Billable Expense G/L Numbers from 71000 to 75999. See GL Number Restrictions.

We will assume you wrote 2 manual checks (not computer generated checks) for 2 different Cash Disbursements.

$500 for Chemical Treatment (which is GL Number 74040 in the Sample data) on Well #1

$100 for Office Rent (GL Number 76200)

The Chemical Treatment check is a Billable Expense to Investors. See GL Number Restrictions.

The Office Rent check is NOT billable to Investors.

Both checks were written on your Cash Account in the First National Bank (11010). Note: The Bank program will be updated for the check written.

To enter Both Disbursements, you will:

Debit 74040 for 500 dollars (Chemical Treatment Check)

Credit 11010 for 500 dollars.

Debit 76200 for 1000 dollars (Office Rent Check)

Credit 11010 for 1000 dollars.

ENTER JOURNAL ENTRIES FOR A CASH DISBURSEMENT

A Cash Disbursement is entered through the Add Transaction screen. There are 3 ways you can get to the Add Transaction Screen.. It doesn't matter which method you use. The Quick Menu and Quick buttons are designed to save you time when you become more proficient.

1) From the Drop Down Menu, select Transactions, then Transactions again, then Add.

2) From the Quick buttons on the far left of the Main Screen, you can click on the +Trans button.

3) From the Quick Menu, select Transactions, then Add GL Transactions.

Using one of the methods above will take you to the following screen.

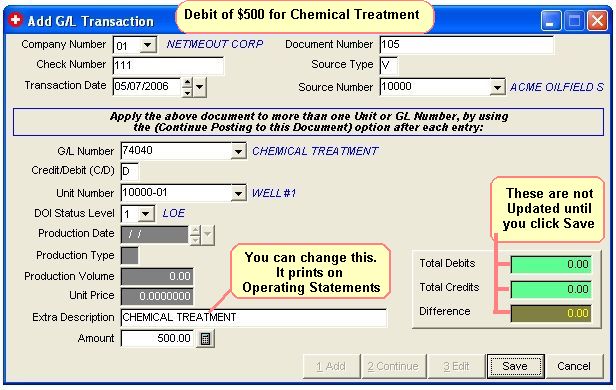

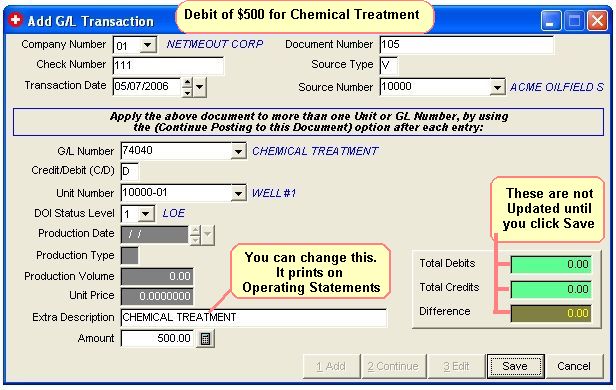

Debit for the Chemical Treatment by entering values as appear on above image.

Click Save.

Then Click Continue to add the Credit to the Cash account for the same check.

Note: When we use the Save then Continue option, the top of the screen remains the same.

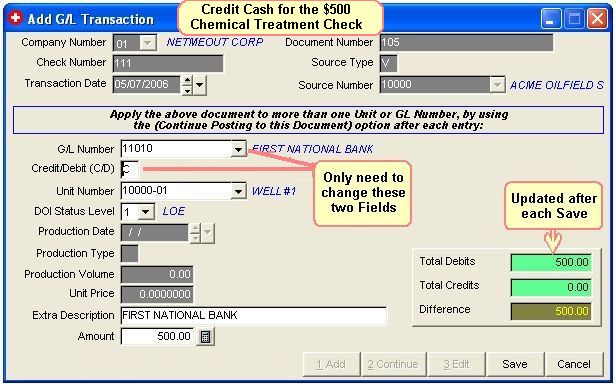

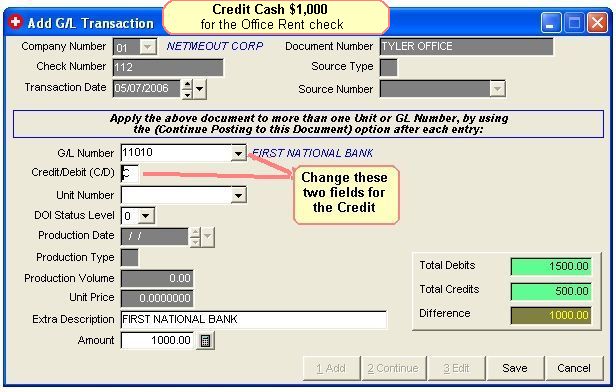

To Credit Cash account for Check Number 111, complete as in image above. You only need to change two fields as indicated in above image.

Click Save. That completes the Debits and Credits for the first check.

For the next check.

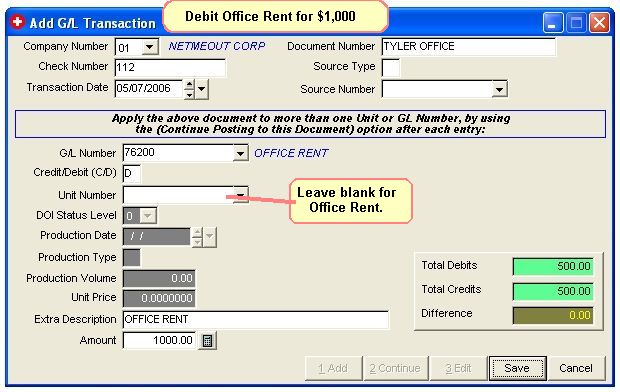

Click Add to add the transactions (Debit and Credit) for the next check you wrote for Office Rent.

Enter the Debit for the Office Rent check you wrote for the Tyler Office as above.

Click Save. Then click Continue to add the Credit.

Change the GL Number to 11010 and the Credit/Debit to C, as above.

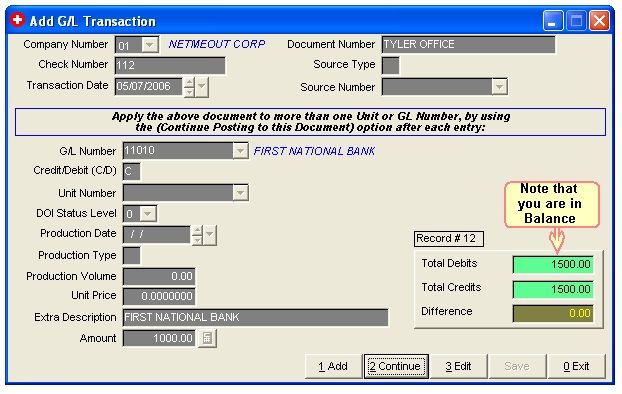

Click Save.

Be sure you are In Balance. The Debits should equal the Credits and the Difference should be zero.

Click Exit.

You have finished adding the Journal Entries for two Cash Disbursements - two sets of Debits and Credits.

CHECK NUMBER: Used to update the Bank file. We are pretending you wrote a hand written check, and we would enter the number of that check.

DOCUMENT NUMBER: Used as a trace number for the check or invoice. Normally for Cash Disbursements use the check number. Amount of check and check number will be updated to the Bank program.

TRANSACTION DATE: This date is used when specifying beginning and ending dates for Operating Statements, Period Close routines, etc… Use the same transaction date for all entries, such as 01/01/2006.

Tip on Dates: You can use a Quick Key to quickly insert dates into the date field.

SOURCE TYPE AND SOURCE NUMBER: Used to locate and print the source name when printing Operating Statements. The Vendor Number must exist in your Vendor file. Otherwise, only used to help you trace the source of the document. You can enter a blank (<enter>), if you don't use these fields. The source type is the type of file and the source number is the code number used in your file.

G/L NUMBER: The account number used for posting debit and credit entries to the General Ledger. The G/L used must reside in Company Chart of Accounts. For every credit entry, you must have a debit entry to keep the G/L in balance.

UNIT NUMBER: Normally the Well Number. If you don't enter a Unit number, the Transaction is not used when printing Operating Statements.

DOI STATUS LEVEL: Used here the same as for the Accounts Payable Invoice. The status indicates which percentage in the DOI file to use for each investor. The Status defaults to the status value stored in the Unit file, allowing you to depress the <enter> key to quickly accept the default value or you can change the status to be used. If NO Unit Number is entered the Status defaults to zero.

OIL/GAS PRODUCTION DATE: Only necessary when entering a run check for sales and taxes. Used to update monthly production volume for sales and taxes to Well Analysis Report. Production date for sales and tax G/L numbers will be reflected on revenue check stub if detailed is listed.

PRODUCTION TYPE AND PRODUCTION VOLUME: This is only necessary when entering a run check. Production type is used to trigger printing a volume on the Operating Statement and to update the Unit/Well file with production history volumes. Use O for oil or G for gas. Production volume will not be used if type is not O or G. This field is not used here when entering the make believe Cash Disbursement, since it is not a run check and has no bearing on any production volume.

UNIT PRICE: Only necessary when entering a Run Check and it is the price per unit in MCF's or BBL's. Some states now require this to be printed on the Operating Statements.

EXTRA DESCRIPTION: The description entered here is printed on the Operating Statements for the investors. The General Ledger Description is normally printed on Operating Statements, but if you need more description enter it in this field.

AMOUNT: Enter the amount to be posted for this record. After entering the amount, select 0 = Exit for entering cash disbursements.

FILES UPDATED FOR TRANSACTION ENTRIES

TRAN.DBF - Stores all debits and credits.

BANK.DBF - Stores deposits & checks posted to cash account to be used for Bank Reconciliation report.

Reports To Verify Entries

Monthly Transaction Listing - Should contain every debit and credit entered and total to zero.

Related Topics

How to Edit/Delete a Transaction ~ Accounting for Dummies ~ GL Number Restrictions

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.